Articles

Shari’ah Supervision

in Islamic Banks and Financial Institutions;

An Overall Review

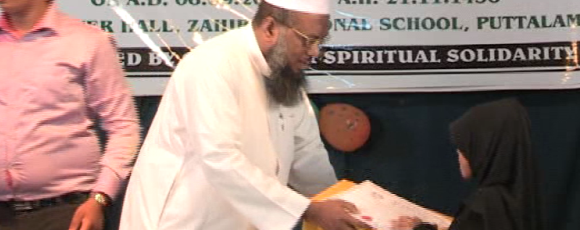

Ash-Shaikh

H. Abdul Nazar

President, Centre for Spiritual Solidarity

General Secretary, All Ceylon Jamiyyathul Ulama

Abstract

This

paper endeavours to give hints to design

a firm framework for Shari’ah supervision

in Islamic banks and financial institutions

within the parameters of contemporary

developments. It also offers instructive

understanding of basis for Shari’ah

supervision in such establishments from

an Islamic perspective.

This

article investigates the importance of

Shari’ah supervision in institutions

of Islamic banking and finance, qualifications

of Shari’ah supervisors and their

role. The definition of Shari’ah

supervision, selection of Shari’ah

supervisors, method of decision making,

role of In-house Shari’ah supervisors,

obstructions facing Shari’ah supervisory

boards, etc. are explored in this article.

Shari’ah

compliance in Islamic banks and financial institutions

is, really, very crucial and depend anything and everything

on it. It should be necessarily maintained in all

their bearings with no excuse since the whole show

is based on laws laid down by Almighty Allah.

The growing trend is that the general public particularly

investors and clients irrespective of faith look for

spotlessness of the operation in these establishments.

Islam is clean and pure and things happening in its

name must, also, be clean and pure. Otherwise, ultimately

the name of this very great and noble divine religion

will get tarnished and its infallible teachings will

be misconstrued.

Therefore, being true to its word and committed to

applying the regulations and ethics in terms of Islamic

banking and finance, each and every institution of

this nature has to prove that it falls into line with

Shari’ah.

Significance of Shari’ah Supervision

The

fundamental reason for emergence of Islamic banks

and financial institutions is to provide a Shari’ah

alternative to interest-based banks and financial

institutions. That is why each institution of Islamic

banking and finance has a Shari’ah supervisory

board as an intrinsic part of its organizational structure.

It is now embedded in everybody’s mind that

any establishment claiming to be an Islamic bank or

an Islamic financial institution is incomplete without

a proper Shari’ah supervisory board to ensure

its purity and accuracy in the eyes of Shari’ah.

In

this background, supervising the entire operation

in such institutions offering Islamic banking and

financial services and their adherence to the tenets

of Shari’ah in all activities is, of course,

indispensable.

That

most of the workers in these institutions lack knowledge

of Islamic banking and finance is another element

that demands Shari’ah supervision. However magnificent

the infrastructure in such an institution is, it is

extremely illogical for it to assert Shari’ah

compliance when its workers are not conversant with

Islamic banking and finance.

The

present modern world has seen a number of new forms

of trade which in some cases do not have reference

in the old treatises of Islamic Jurisprudence (Fiqh).

Even if the reference is available, the bankers are

incapable of reading, understanding and interpreting

them. This is another factor that contributes to the

fact that Islamic banks and financial institutions

need to be kept under the supervision of Shari’ah

scholars.

Running

an Islamic bank or financial institution, indeed,

entails people, money, property, etc. with a large

number of dealings, transactions and investments.

So the day-to-day operation possibly encounters problems

and cases which should be addressed in the light of

Shari’ah. Here comes the key role of Shari’ah

scholars who can solve them by applying the Shari’ah

principles. For this reason too, the constant Shari’ah

supervision is of paramount importance.

It

is public knowledge that with ulterior motive of money

making, some unscrupulous people have established

institutions in the name of Islamic banking and finance.

Though their memorandum and articles and / or rules

spell out that the whole operation and conduct of

business should conform to the doctrines of Shari’ah,

it is not so in practice. They do not want to commit

to applying of Shari’ah principles either. This

saddening phenomenon, which sometimes makes the whole

thing absurd, compels other institutions with real

commitment to adhering to Islamic principles both

in word and deed to be under the Shari’ah supervision.

By

and large, all these establishments ought to have

full-time Shari’ah supervision as expected by

investors, clients and general public at large and

forced by nature as things have developed.

What is Shari’ah Supervision?

The

Shari’ah supervision has been defined by various

institutions and scholars in different ways. The all-embracing

one is ‘Shari’ah supervision in essence

is to ensure that Islamic banks and financial institutions

conduct their business in accordance with the Islamic

principles, rules and etiquette as guided, advised

and instructed by the Shari’ah supervisory boards’.1

It

is crystal clear from the above definition that two

areas receive the focus of the Shari’ah supervision;

viz application of principles and application of etiquette.

Islam in general does not lay down the rules alone;

but it formulates a framework for their application.

This framework requires inter alia application of

rules and ethics both side by side. Islamic Banking

and Finance is not an exemption.

Basis for Shari’ah Supervision

Supervising

the market place for Shari’ah compliance is

not new or alien. If one looks at the history of Islam,

he / she could easily find that this was practiced

by Prophet Muhammad (Sallallahu alaihi wasallam).

It is recorded by Imam Muslim (Rahimahullah) on the

authority of Aboo Hurairah (Radhiyallahu anh) that

Allah’s Messenger (Sallallahu alaihi wasallam)

passed by a heap of a foodstuff. He inserted his hand

into the heap. His fingers sensed dampness. ‘What

is this? O owner of the foodstuff!’ asked Allah’s

Messenger (Sallallahu alaihi wasallam). The owner

said: ‘It got wet in rain. O Allah’s Messenger!’.

Then said Allah’s Messenger (Sallallahu alaihi

wasallam): ‘Why had you not kept it over in

order that people would notice it? The one, who deceives,

is not from me.’2

The

practice adopted by Allah’s Messenger (Sallallahu

alaihi wasallam) in supervising the market activities

did not end with his demise, but continued throughout

the caliphate of four caliphs (Radhiyallahu anhum).

The Islamic caliphate had a separate department called

‘Al-Hisbah’. The chief task assigned to

Al-Hisbah was to enjoin what is right if it is abandoned

and forbid what is wrong if it is perpetrated. This

embodied among other things monitoring the business

activities in the market.3

Selection of Shari’ah Supervisors

To

perform the heavy task of supervising the show in

the Islamic banks and financial institutions, a handful

of Islamic scholars are selected by the institutions.

In some establishments, board of directors handles

the selection, and in some, stakeholders do it. The

way of selection and appointment may vary, yet the

job entrusted to the Shari’ah scholars thus

selected and appointed is same.

A

minimum three (03) members are needed to constitute

a full Shari’ah supervisory board.

Duties

Involved in Shari’ah Supervision

The

job of supervising includes amongst other things the

following responsible duties:

- to examine the Shari’ah aspects in the institution’s memorandum and articles, rules, etc.

- to vet for Shari’ah compliance manuals, agreements, contracts, rules and regulations, bonds, promissory notes and all other documentation.

- to introduce more and more Shari’ah compatible products.

- to study proposals of new investment ventures.

- to lay down necessary rules to regulate the relationship with un-Islamic banks and financial institutions.

- to expound the Shari’ah position on transactions referred to the Shari’ah supervisory board for Shari’ah clearance.

- to audit for Shari’ah compliance all dealings, transactions and operations of the institution, to make observations and to follow up rectification of shortcomings before anything else.

- to stipulate that any new product, investment or service should have the approval of the Shari’ah supervisory board before embarking on it.

- to provide Shari’ah advices with regard to dealings, transactions and operations of the institution.

- to act on complaints from the standpoint of Shari’ah.

- to audit for Shari’ah compliance all investment, facility and transaction related files and documents.

- to analyze the budgets, auditors’ reports, etc.

- to present periodical reports in which the Shari’ah supervisory board airs its opinions in respect of dealings and transactions carried out and the institution’s upholding of and complying with Fatwas (Islamic rulings), decisions, guidance, etc. of the Shari’ah supervisory board.

- to adjudicate transactions that have run into dispute.

- to

stipulate that manuals, agreements, contracts, rules

and regulations, bonds, promissory notes and all other

documentation should have the approval of the Shari’ah

supervisory board before bringing them into effect.

The

advisory and supervisory role of Shari’ah supervisory

boards nowadays includes Shari’ah audit too. The Shari’ah

supervisory boards perform audits either annually,

biannually or monthly, as the case may be. However,

it is difficult for the Shari’ah supervisory boards

with a limited number of members to review all the

transactions that have taken place in different branches

of the institutions. It would, therefore, be ideal

and practical to form independent Shari’ah audit firms

in the private sector or that the existing chartered

audit firms acquire necessary expertise to undertake

the Shari’ah audit. In both cases, the firms need

to hire and train adequate staff to conduct the Shari’ah

audit effectively and impeccably. Nevertheless, if

the existing chartered audit firms can come forward

to undertake this job, it will be most welcomed with

open arms by Islamic banks and financial establishments

as this would be more convenient for them to have

the Shari’ah audit and accounts audit at a same time.

The renowned scholars and researchers M. Umer Chapra

and Habib Ahmed also have suggested same.4

Qualifications of Shari’ah Supervisors

Even by cursory reading of the duties mentioned

above, one can appreciate the grave and serous responsibility

shouldered by Islamic scholars engaged in the Herculean

job of supervising the institutions of Islamic banking

and finance. Therefore, picking out Ulama for this

assignment has to be handled with utmost care and

due prudence. We have an age-old adage in Arabic

that:

‘أعـط الـقـوس بـاريـهـا’

‘Give

the bow to the one who knows how to shape it’.

Generally the following qualifications should be

essentially found in such scholars as suggested

by some eminent Ulama like Shaikh Hamzah Abdul Kareem

Muhammad Hammad:5

- They should be well-versed in the

Holy Qur’an and its Sciences.

- They should have thorough knowledge of Sunnah and its Sciences.

- They should know well the cases of Ijma’ (Consensus of Ulama on a matter).

- They should be proficient in Arabic.

- They should have cognizance of individual reasoning (Ijtihaad) of Islamic Jurists, evidences in support of their opinions, bases of their views, reasons for their differing in views, etc.

- They should be conversant with Principles of Jurisprudence (Usool Al-Fiqh).

- They should be knowledgeable about Intents of Shari’ah (Maqaasid Al-Shari’ah).

- They should be familiar with general banking practices.

- They should bear good character both in personal and public life.

- They

should be able to act impartially in delivering Fatwas

(Islamic Rulings) and adjudicating of disputes.

In fact, everyone will agree that it is beyond question and argument that the aforesaid conditions are fair and reasonable as far as the job involved is concerned.

Planning and Scheduling

Carrying out any task; big or small, easy or uphill needs proper planning and scheduling. Shari’ah scholars’ job of supervision requires a comprehensive program to monitor all the activities of the institutions and a detailed timetable for this purpose, meetings and audits. It is also imperative that Shari’ah supervisory boards have model formats to collect and collate data and write supervision and other reports.

Scope of Responsibility

The entire operation of the establishments

in the field of Islamic banking and finance must conform

to Shari’ah. Showing Shari’ah in front and face and

ignoring it behind the curtain is violation of Shari’ah

and taking people especially the investors for a ride.

It should, also, be noted that Shari’ah compliance

is not complete by mere paperwork only. It needs physical

application to be completed. Here a question automatically

arises ‘Who is responsible for this?’

The answer is simple. Boards of directors

are responsible for running the institutions according

to Shari’ah principles and values and Shari’ah supervisory

boards are responsible for ensuring that the operation

is in harmony with Shari’ah. This necessitates complete

transparency in all stages and aspects.

Procedure for Decision Making

There ought to be a clear-cut system

adopted by each Shari’ah supervisory board in making

decisions and delivering Fatwas (Islamic Verdicts).

All decisions must be taken in conformity with Al-Qur’an

and Al-Sunnah, and the Fiqh Schools of Thought (Math-habs)

have to be taken into consideration for such decisions.

In the event of difference of opinions on any matter

or issue, the opinion of the majority of the members

most supported by the evidences shall be final.

Before concluding on anything, the

members of Shari’ah supervisory boards must study

it in depth. If necessary, experts could be consulted.

In any case, they shall not rush to issue any Fatwa

before close analysis of the matter or issue in the

light of Shari’ah.

Libraries are pregnant with treatises

containing marvelous studies of Islamic jurists especially

in areas of economy, trade and commerce. These books

should be referred to at times of attempting to deliver

Fatwas.

It is imperative, while making efforts to issue a Fatwa, to closely look at the context and intent of a text in the Holy Qur’an or Sunnah.

Fatwa changes as time and place change’ (الفتوى تختلف باختلاف الزمان والمكان).

This is a general rule accepted by great Islamic jurists

throughout the ages. Shari’ah supervisory boards must

take this also into account in the event of delivering

Fatwas.

There are some other general rules agreed upon by

all Islamic jurists;

‘Hardship brings simplification’ (المشقة

تجلب التيسير),

‘Worse evil is removed by lesser evil’ (الضرر

الأشد يزال بالضرر الأخف),

‘Public welfare is given preference over personal

welfare’

(المصلحة العامة مقدمة

على المصلحة الخاصة),

‘Warding off evils is given preference over procurement

of virtues’

(درأ المفاسد مقدم على

جلب المصالح),

‘Necessities permit forbidden things’ (الضرورات

تبيح المحظورات), etc.

Scholars benefit from one another,

exchange views and share knowledge and experience.

No scholar is perfect. No Shari’ah supervisory board

should think that they are self-sufficient and therefore,

need not consult other Ulama nor benefit from their

knowledge and experience. Each Shari’ah supervisory

board has to consider the decisions and Fatwas of

Fiqh academies and other institutions that organize

conferences and assemble Ulama of eminence to make

collective studies and deliver Fatwas on important

matters and issues. In most cases, as proven practically,

collective efforts outweigh individual efforts.

All this naturally requires that

the members of Shari’ah supervisory boards should

keep them updated by intensive reading and reference

and keep abreast of current affairs and new developments

that take place in Islamic banking and finance.

In-house Shari’ah Supervisors

As discussed earlier, the advisory

and supervisory role of the Shari’ah supervisory boards

is a tremendous responsibility and a challenging job

and it certainly entails a great degree of fastidious

perusal, consultation, reference and meticulous research.

Are the scholars who serve on Shari’ah supervisory

boards in a position to spare time to act their part

duly and effectively? This is a pragmatic question.

In reply to this, the scholars have suggested having

in-house Shari’ah supervisors full-time inside the

institutions.6

In-house Shari’ah supervisors primarily

ease the burden of the members of Shari’ah supervisory

Boards by carrying out most of the duties technically

entrusted to them. In the meantime, in-house Shari’ah

supervisors may act as secretaries to their respective

Shari’ah supervisory boards. So, in this way, convening

of Shari’ah supervisory board meetings, minuting the

proceedings of meetings, maintaining such minutes

and other Shari’ah related documents, etc. may rest

with them as agreed between the managements and Shari’ah

supervisory boards.

As in-house Shari’ah supervisors

are expected to perform the duties of Shari’ah supervisory

boards, the institutions should necessarily look for

Shari’ah scholars with the qualifications stipulated

for members of Shari’ah supervisory boards and appoint

them. Only those, who fit the bill, should be appointed

formally. Such appointees have to work in the establishments

on a full-time basis and they are technically their

employees. However, the regulators of Islamic banks

and financial institutions very precisely say that

even though they are employees in such establishments,

they are fully independent in the assessment of Shari’ah

compliance and should not be influenced at all by

managements or any others. They also enjoy complete

freedom to report to Shari’ah supervisory boards on

any matter or issue.7

Obstacles Confronting Shari’ah Supervisory

Boards

Circumstances warrant analyzing the barriers before

Shari’ah supervisory boards. Of course, Shari’ah supervisory

boards face numerous obstructions that could be outlined

as follows:

- Shortage of Ulama fulfilling the conditions set out for members of Shari’ah supervisory boards.

- Rapid and tremendous developments and sudden changes in trade and economy and difficulty in expounding the Shari’ah position then and there, keeping pace with the latest developments and unexpected changes.

- Lethargy of managements in implementing the decisions of Shari’ah supervisory boards.

- Carelessness of managements about following the guidance of Shari’ah supervisory boards to the letter.

- Non-implementation by managements of guidelines issued by Shari’ah supervisory boards.

- Pressurizing by managements of Shari’ah supervisory boards to approve some of their dealings or transactions which are not in harmony with Shari’ah.

- Poor

performance of Shari’ah supervisory boards in their

duty.

In

order to overcome theses obstacles, it is proposed as

follows:

- to pick out and appoint only the scholars who meet the qualifications stated earlier.

- to support Shari’ah supervisory boards with banking experts.

- to establish institutes to train Ulama in Islamic banking and finance.

- to establish independent Shari’ah audit firms and to motivate existing chartered audit firms to prepare them to undertake Shari’ah audits.

- to let Shari’ah supervisory boards examine and review closely every activity of the institutions; major or minor with complete transparency and without let or hindrance or pressure form anyone.

- to make it compulsory that the establishments should adhere to the guidance of Shari’ah supervisory boards, put their decisions into practice and rectify the shortcomings as directed by them.

- Scholars

shall equip themselves well with English knowledge

since it is the working language in most of these

establishments.

The Shari’ah supervision shall be

meaningful, efficient and effective in its full sense.

Ulama especially young ones must arm themselves with

necessary knowledge in this sphere and good command

of English. Institutions of Islamic banking and finance

should operate in line with Shari’ah with honesty,

integrity and complete transparency to Shari’ah supervisory

boards. They must always remember that they all deal

with divine laws not man-made laws.

People everywhere at all times like

to deal and bank with credible establishments in the

market.

Endnotes

- Hamzah Abdul Kareem Muhammad Hammad, Al-Raqaabah Al-Shar’iyyah Fee Al-Masaarif Al-Islamiyyah (Amman: Daar Al-Nafaais, 2006) 30 - 32

- Aboo Al-Husain Muslim Ibn Al-Hajjaj, Saheeh Muslim, Book of Iman, Chapter: Saying of Prophet (Sallallahu alaihi wasallam): ‘The one, who deceives us, is not from us’

- Abdul Azim Islahi, Economic Concepts

of Ibn Taimiyah (United Kingdom: The Islamic Foundation,

1996) 42, 186 – 191

Al-Khulafa’ Al-Raashidoon Wa Al-Dawlah Al-Umawiyyah for Intermediate Second Year (Kingdom of Saudi Arabia: Ministry of Higher Education, Fifth Edition) 182 - M. Umer Chapra and Habib Ahmed, Corporate Governance in Islamic Financial Institutions (Jeddah: Islamic Development Bank, 2002) 68 - 69

- Hamzah Abdul Kareem Muhammad Hammad, Al-Raqaabah Al-Shar’iyyah Fee Al-Masaarif Al-Islamiyyah, 43 - 51

- Banking Advisory Committee of All Ceylon Jamiyyathul Ulama, Standards for Islamic Financial Institutions Seeking Accreditation by All Ceylon Jamiyyathul Ulama, 10

- Banking

Advisory Committee of All Ceylon Jamiyyathul Ulama,

Standards for Islamic Financial Institutions Seeking

Accreditation by All Ceylon Jamiyyathul Ulama, 10

- 11

02.08.2008

*Behaviour shaping strategies in islam

*Misunderstanding of Islam; Cause for Islamophobia

*Capital punishment an islamic perspective

*Shari’ah Supervision in Islamic Banks and Financial Institutions

*Major Sins; a Brief Discussion

*Criticize the Way Law was Implemented not the Law

* 47 YEARS OLD

* AMENDMENTS TO MUSLIM MARRIAGE AND DIVORCE ACT

* BRINGING ABOUT REFORMS TO MUSLIM MARRIAGE AND DIVORCE ACT

* AMENDMENTS TO MUSLIM MARRIAGE AND DIVORCE ACT - PART 01

* AMENDMENTS TO MUSLIM MARRIAGE AND DIVORCE ACT - PART 02

* ARTICLES WRITTEN BY MARHOOM M.M.M. MAHROOF ON MUSLIM PERSONAL LAW IN SRI LANKA

* HALAL AND HARAM IN FOOD AND BEVERAGE

* WHAT LOVE CAN DO

* QUALITY POLITICIANS

* THANKS FOR CONDOLENCES

* DO NOT SAY ‘MUBAARAKALLAH’

* REGULATING AND STANDARDIZING MADRASAHS

* QUAZI SYSTEM AN ISSUE IN HAND

Jumuah Khutbah

Jumuah Khutbah Weekly Fiqh Class for Adults

Weekly Fiqh Class for Adults Special address At prize-giving

Special address At prize-giving